We are Virtual, and we offer e-filing in all 50 states.

We are Virtual, and we offer e-filing in all 50 states.

We are Virtual, and we offer e-filing in all 50 states.

We are Virtual, and we offer e-filing in all 50 states.

We are Virtual, and we offer e-filing in all 50 states.

We are Virtual, and we offer e-filing in all 50 states.

We are the home of the $100 referral fee!

We are the home of the $100 referral fee!

We are the home of the $100 referral fee!

We are the home of the $100 referral fee!

We are the home of the $100 referral fee!

We are the home of the $100 referral fee!

About Us

Your Trusted Partner for Tax Compliance: Miss Tax Savvy Tax Office - Smart Strategies for Your Financial Success

At Miss Tax Savvy Tax Office, we believe that every client deserves personalized attention and expert guidance when it comes to their taxes. Our team of experienced tax professionals is dedicated to helping you navigate the complexities of tax laws while maximizing your savings and ensuring compliance.

We pride ourselves on our commitment to transparency, integrity, and exceptional customer service. Whether you're an individual, a small business owner, or looking for specialized tax strategies, we tailor our services to meet your unique needs.

With our up-to-date knowledge and innovative approach, we aim to empower you to make informed financial decisions. At Miss Tax Savvy, your financial well-being is our top priority. Let us take the stress out of tax season and help you achieve your financial goals!

Access the Client Tax Organizer

Get Your Tax Preparation Checklist!

How Can We Make This a Smooth Experience?

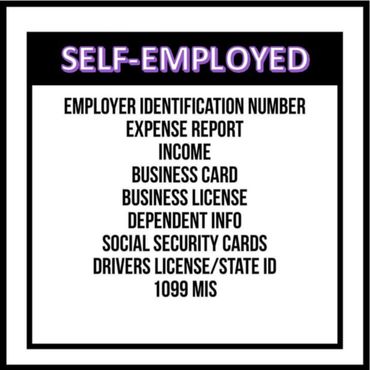

Let's Ease Your Mind with What You Should Bring

At Miss Tax Savvy Tax Office, we transform the often daunting task of tax preparation into a friendly and efficient experience. Our expert team is dedicated to maximizing your refunds while minimizing your stress. With personalized service and a warm environment, we ensure every taxpayer leaves feeling informed and empowered.

So, let's begin with what you should bring to your tax preparation session (or enter into the tax organizer online? The answer can be found in this handy Tax Preparation Checklist. (Please click the highlighted, underlined words for the checklist, if you did not already get it at the top of the page.)

By coming prepared with these documents, you can help to ensure a smooth and efficient tax preparation process. Let Miss Tax Savvy Tax Office guide you through the complexities of taxes, so you can focus on what really matters—your financial future!

Essential Tips Every Taxpayer Should Know

1. Know Your Deadlines:

- Be aware of tax filing deadlines and extensions to avoid penalties. The typical deadline is April 15th, but it may vary.

2. Understand Your Filing Status:

- Your filing status (single, married filing jointly, head of household, etc.) affects your tax rate and eligibility for certain deductions and credits.

3. Keep Accurate Records:

- Maintain organized records of income, expenses, and receipts throughout the year. This simplifies tax preparation and helps support your claims.

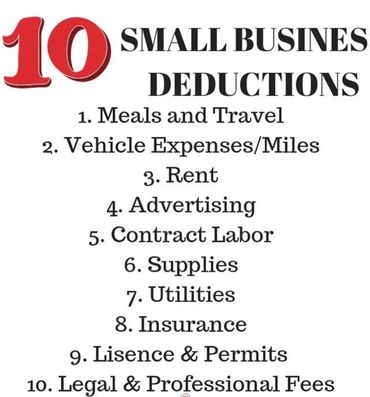

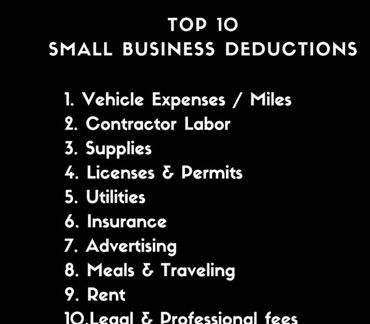

4. Maximize Deductions and Credits:

- Familiarize yourself with available deductions (e.g., mortgage interest, medical expenses) and tax credits (e.g., Earned Income Tax Credit) to reduce your tax liability.

5. Consider Professional Help:

- If your tax situation is complex, consider hiring a tax professional for guidance, especially for investments, self-employment, or significant life changes.

6. Be Aware of Tax Scams:

- Protect yourself from scams by knowing legitimate communication from the IRS. The IRS will never ask for personal information via email or text.

7. Review Tax Changes:

- Stay updated on changes in tax laws that may affect your situation. This includes adjustments to standard deductions and new tax credits.

8. Plan for Next Year:

- Reflect on your current year's tax situation to make adjustments for the upcoming year. This could involve changing your withholding or planning for deductible expenses.

9. File Electronically:

- E-filing is generally faster and more secure than paper filing. Plus, it often results in quicker refunds.

10. Consider Retirement Contributions:

- Contributions to retirement accounts like IRAs or 401(k)s can lower your taxable income and help you save for the future.

11. Know Your Rights:

- Familiarize yourself with taxpayer rights, including the right to appeal IRS decisions and to receive fair treatment.

12. Plan for State Taxes:

- Don’t forget about state and local taxes, which may have different rules and deadlines.

By keeping these essential points in mind, taxpayers can navigate their tax responsibilities more effectively and potentially save money in the process!

Track Important Tax Information

Here are direct links.

Miss Tax Savvy

Photo Gallery

Just for You...

Understanding FICO

Prioritize your Debt

Prioritize your Debt

The FICO scoring model is the one most widely used by the majority of major lenders. Here is almost everything you need to know about it.

Prioritize your Debt

Prioritize your Debt

Prioritize your Debt

Coming from the National Consumer Law Center, here is a very easy-to-read guide on prioritizing debt.

"What's the Score?"

Prioritize your Debt

"What's the Score?"

We are pleased to announce the launch of our brand new podcast, "What's the Score?" Airing weekly on Spotify and Anchor.

Copyright © 2018 Clear Choice Financial Solutions LLC - All Rights Reserved.

Welcome!

Welcome and thank you for stopping by!

Also, welcome to Tax Season 2026!

We provide tax preparation services based on appointments, though you must complete the Tax Organizer prior to the start of your appointment.

Please click HERE for your Tax Organizer.

If you have any questions about credit or would like to schedule a CreditRX Discovery Session, our team is here to help.

Please feel free to get a complimentary copy of our Credit Repair Guide. Click HERE!

- Clear Choice Financial Solutions LLC /Miss Tax Savvy

Cookie Policy

This website uses cookies. By continuing to use this site, you accept our use of cookies.